How to Incorporate Blockchain Technology in Your Fintech Mobile App

Financial technology (fintech) has become an essential component of our lives in the quickly changing world of today. Businesses must work to provide safe, effective, and transparent solutions as more and more people rely on mobile applications for their financial requirements. Blockchain technology can help in this situation. Blockchain has unmatched opportunity to improve the security, trust, and usefulness of fintech mobile apps because of its decentralized structure and immutable ledger. The essential stages to successfully integrating blockchain technology into your financial mobile app will be covered in this blog article.

- Identify the Use Case: It is essential to determine the precise use case for your financial mobile app before integrating blockchain. Blockchain technology has several uses, including supply chain financing, smart contracts, cross-border payments, and digital identity verification. In order to ascertain how blockchain might address their issues and give value, it is important to comprehend your target audience and their difficulties.

- Choose the Right Blockchain Platform: Once the use case has been determined, it is critical to choose the best blockchain platform. Popular options include Ethereum, Hyperledger Fabric, and Corda, each of which has certain benefits and features. Think about things like smart contract capabilities, scalability, security, and consensus mechanisms. Evaluate the platform you have chosen as well as the development community, resources, and support.

- Design Secure Smart Contracts: Self-executing contracts known as “smart contracts” are agreements with set rules and conditions that are maintained on a blockchain. They do away with middlemen, cut expenses, and guarantee openness. Designing reliable and secure smart contracts is essential when incorporating blockchain into your financial mobile app. Since smart contracts handle financial transactions, rigorous security audits, the use of best practices in coding, and adequate testing should all be done to prevent vulnerabilities.

- Implement User Wallets: A user wallet is a crucial part of a mobile financial application enabled by blockchain. It enables users to transact, communicate with the blockchain network, and securely store their digital assets. Put an emphasis on security methods like encryption, two-factor authentication, and biometric authentication when integrating user wallets. Create a user-friendly interface that makes it simple to navigate blockchain features and gain seamless access to funds.

- Ensure Regulatory Compliance: Global regulatory organizations are paying more attention to blockchain technology. To ensure the profitability and legality of your fintech mobile app, compliance with pertinent rules and regulations is essential. Know Your Customer (KYC), Anti-Money Laundering (AML), and General Data Protection Regulation (GDPR) are a few examples of current financial legislation that you should get familiar with. Include these compliance checks in your app to increase user credibility and confidence.

- Establish Network Connectivity: Connectivity and interaction between many nodes are essential to blockchain networks. To access and update transactional data securely, make sure your fintech mobile app has seamless interaction with the blockchain network. Implement reliable APIs (Application Programming Interfaces) that enable real-time data retrieval, transaction processing, and verification between your app and the blockchain network.

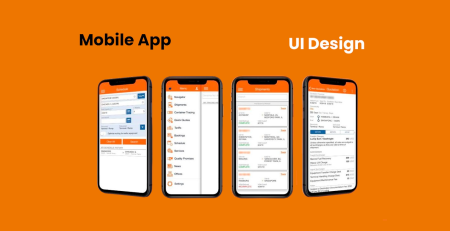

- Focus on User Experience: Always put the user experience first when incorporating blockchain technology into your financial mobile app. Aim for a smooth, understandable, and flexible design that makes complicated blockchain interactions simple. Provide clear instructions on how to use the app’s functionality and educate users on the advantages and features of blockchain. Obtain user input often, then iteratively improve the experience for all users.

Conclusion

Blockchain technology has the potential to completely transform the fintech sector. Businesses may develop fintech mobile applications that give their consumers increased security, efficiency, and confidence by utilizing the decentralization, security, and transparency that blockchain delivers. Choose the appropriate blockchain platform, develop safe smart contracts, implement user wallets, maintain regulatory compliance, build network connection, and put the user experience first. These steps should all be performed with great care. These procedures will help you maximize the benefits of blockchain technology and create a cutting-edge fintech mobile app that will satisfy the demands of your consumers in the modern day.

Leave a Reply